- Category:

- News

The role of workplace EV charging as part of a holistic UK charging network

ESI Technical Specialist Sam Abbott looks at the key takeaways from Cenex’s recent study on the UK’s workplace charging sector.

On Wednesday 8th June, clean transport campaign group Transport & Environment released a briefing calling on the UK government to go further to deliver a world class charging network by 2030. This commentary was based on a study completed by Cenex earlier this year investigating the state of play of UK’s easy-to-forget workplace charging network. It found that there are nearly as many workplace chargepoints than public chargers for electric vehicles in the UK – nearly doubling the amount of infrastructure available to drivers.

In this article I wanted to share the top five key takeaways from our study but before doing so, we must first enter into our industry’s number one debate…

Is charging infrastructure holding back EV uptake?

If you work in the EV charging industry then you’d have to live under a fairly sizeable rock to avoid the eternal debate of whether public charging infrastructure is keeping pace with EV uptake. Those criticising the rate of public charging deployment quote rising EV per chargepoint statistics (more on whether this the right metric another time perhaps) against a backdrop of new EV registration records set with every passing month. On the other side of the argument you have those that suggest that the number of EVs on our roads is now catching up with infrastructure that has been installed ahead of demand.

If we were to try to calculate the “right” number of chargepoints we would need to take into account many, many factors including: different chargepoint location types, their availability and typical dwell times; existing driving behaviour and trends towards reduced car usage and increased active travel and use of public transport; innovative shared charging solutions to increase utilisation of existing assets; and trends in battery sizes and chemistries, to name just a few. Just thinking about trying to ingest all the necessary data to spit out a single answer gives me a headache. Add in the dilemma of ensuring adequate spatial distribution – after all it’s no good having 300,000 public chargepoints if they’re all on The Isle of Wight (unless perhaps you’re an EV driver living in Cowes) – and I’m reaching for the painkillers and closing the blinds.

I therefore can’t say which side of the argument I support – not for any political reason but simply because I don’t know the answer for certain. The question of “how many”, at a macro level at least, is too nuanced to give a precise answer. So now that I have some sizeable splinters from firmly positioning myself on the fence of that particular debate, here are some useful conclusions that I can make from our recent workplace charging study:

- Don’t forget about [the opportunity for] workplace charging!

In the debate about how many chargepoints we need, chargepoints installed at workplaces are nearly always overlooked. At the time of writing, our research’s best estimate of the number of workplace charging sockets showed that the workplace network is approximately 85% of the size of the public network. This almost doubles the UK’s total EV charging capacity.

“This indicates that workplace charging is likely of similar magnitude to the public charging network and therefore must not be overlooked when evaluating the UK’s overall charging network as a whole””

The barrier to adopting an electric vehicle experienced by those who do not have a private driveway on which to charge is well documented. One estimate puts the proportion of households without off-street parking at 31%, but in reality the number will be higher due to the practical challenges of installing chargepoints in rented accommodation or where the parking space is not adjacent to the building. However, the estimated 33,000 workplace sockets installed will already have supported some of those who are not able to charge at home to transition to EV by providing a reliable opportunity to charge at work. And workplace charging will continue to be strategically important for fleets and the 21.7 million commuting vehicles as part of a holistic UK charging network.

- There is regional disparity of deployment of workplace chargepoints, but this can be misleading.

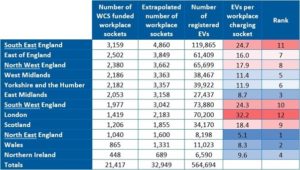

Whilst putting a number on the UK-wide requirement for charging may be nigh-on impossible, things become a little easier at a more local level. The table below shows the number of EVs per workplace charging socket (again, far from a perfect metric) for each UK region. London appears to be the worst-performing region with North East England coming out smelling of roses. Taken at face value, however, these statistics can be very misleading. London’s public network is more mature than most if not all other areas of the UK, with prolific residential on-street charging and an increasing number of rapid charging hubs. At the same time, the number of miles commuted by car is much less and therefore the use case for workplace charging is mostly limited to fleets based in the city.

This demonstrates how it can be vitally important that workplace charging is considered alongside both private (and shared!) domestic and public charging when developing a local or regional charging infrastructure strategy.

- Workplace chargepoints for fleets pay for themselves

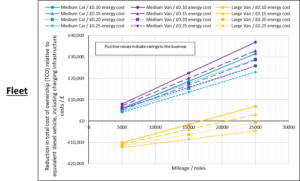

As part of the analysis, we looked at the investment case for business to install workplace charging. The conclusions of this were as follows:

- Workplace charging for company-owned fleet vehicles pays for itself. The operational savings (predominantly fuel) of electric vehicles is sufficient to cover both the vehicle purchase premium and the capital and operational cost of the charging infrastructure. The exception to this rule is for larger vans where the TCO is still challenging due to the significant additional cost of electric versus the diesel equivalent.

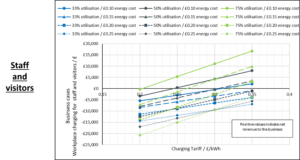

- When deployed for employee-owned commuting and visitor vehicles, the business case is more marginal. Only with high utilisation or a favourable combination of energy costs and charging tariff is the workpacharging infrastructure business case likely to break even.

Whilst the staff and visitor business case is more challenging, there may be other non-economic benefits to the business such as increased staff satisfaction, an additional benefit to offer new employees during recruitment, and improved brand image.

For certain businesses it may be possible to improve the business case by combining the fleet use case with staff and visitors. If the company fleet is operational during the day and recharges overnight, then making the chargepoints available to staff and visitors, or even the general public, during the day can lead to very high utilisation rates and an easy investment decision.

- Many businesses cannot deploy workplace charging as they lease their premises

It is estimated that the proportion of UK businesses that lease their premises could be as high as 80%. These businesses are not able to install workplace charging without the support of their landlord, who may be unwilling to accept the financial risk associated with investing in the infrastructure. This barrier to workplace charging was cited by suppliers and customers interviewed as part of the Cenex study, and shows the importance of legal requirements on landowners to provide EV charging infrastructure. Which leads me to my final key takeaway from the study…

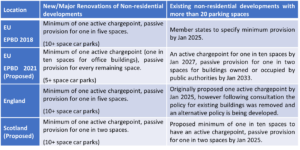

- The design of legislation mandating charging infrastructure in car parks will have a massive impact on the UK’s charging network

Our study reviewed the policies for active and passive provision of EV charging in non-residential car parks (which will include workplace car parks). Currently, of the devolved nations only Scotland has a policy position which includes a requirement for existing developments. England, whose position Wales and Northern Ireland are expected to follow in absence of any formal policy, has reneged on its original proposal to require existing developments to install charging infrastructure. The impact that this would have is huge; if the entirety of the UK followed England’s current position for new developments and major renovations only, the number of sockets deployed is expected to be just 23% of an un-regulated market.

Whilst I am cautious of regulation that mandates charging infrastructure by broad-brush targets that cannot consider the local use case, it is clear that a “do nothing” approach for existing developments is also not acceptable.

In conclusion: don’t forget about workplace charging!

Workplace charging has a big role to play in a successful electric transition, and must not be forgotten for statistics or strategies. Or maybe we’ll end up with lots of stranded assets come 2050 when we’re all walking and cycling to work…